Check your credit score for free with each account login!

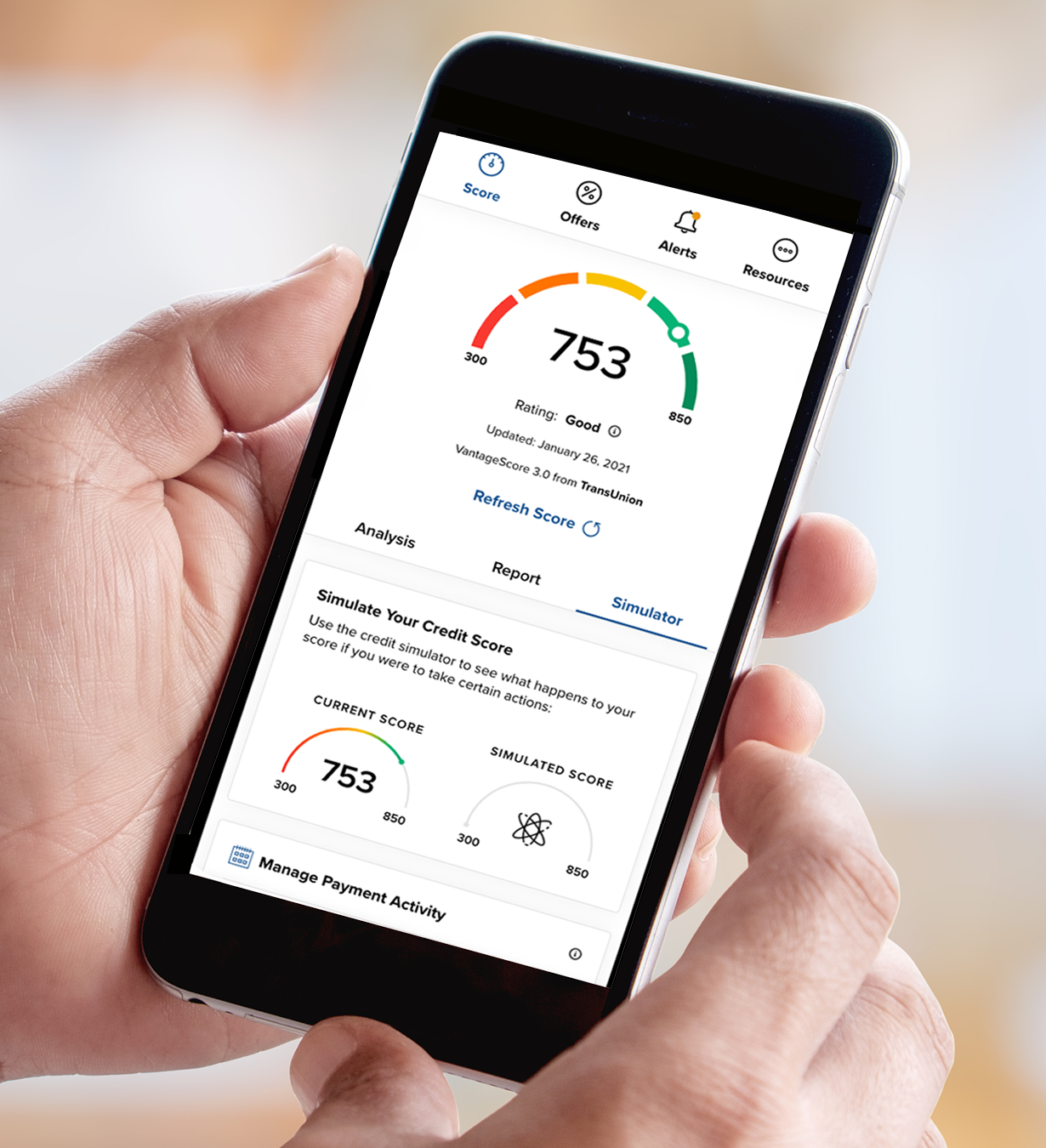

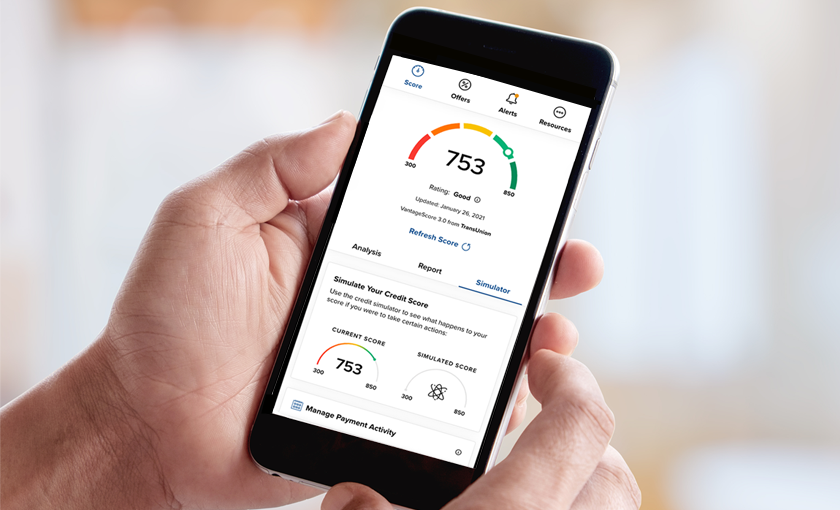

My Credit Rx powered by SavvyMoney® is free inside online banking and our mobile app. With one click, you can check your credit score, view your credit report, get up-to-date credit monitoring updates and much, much more!. With My Credit Rx, you can:

- Check your credit score daily

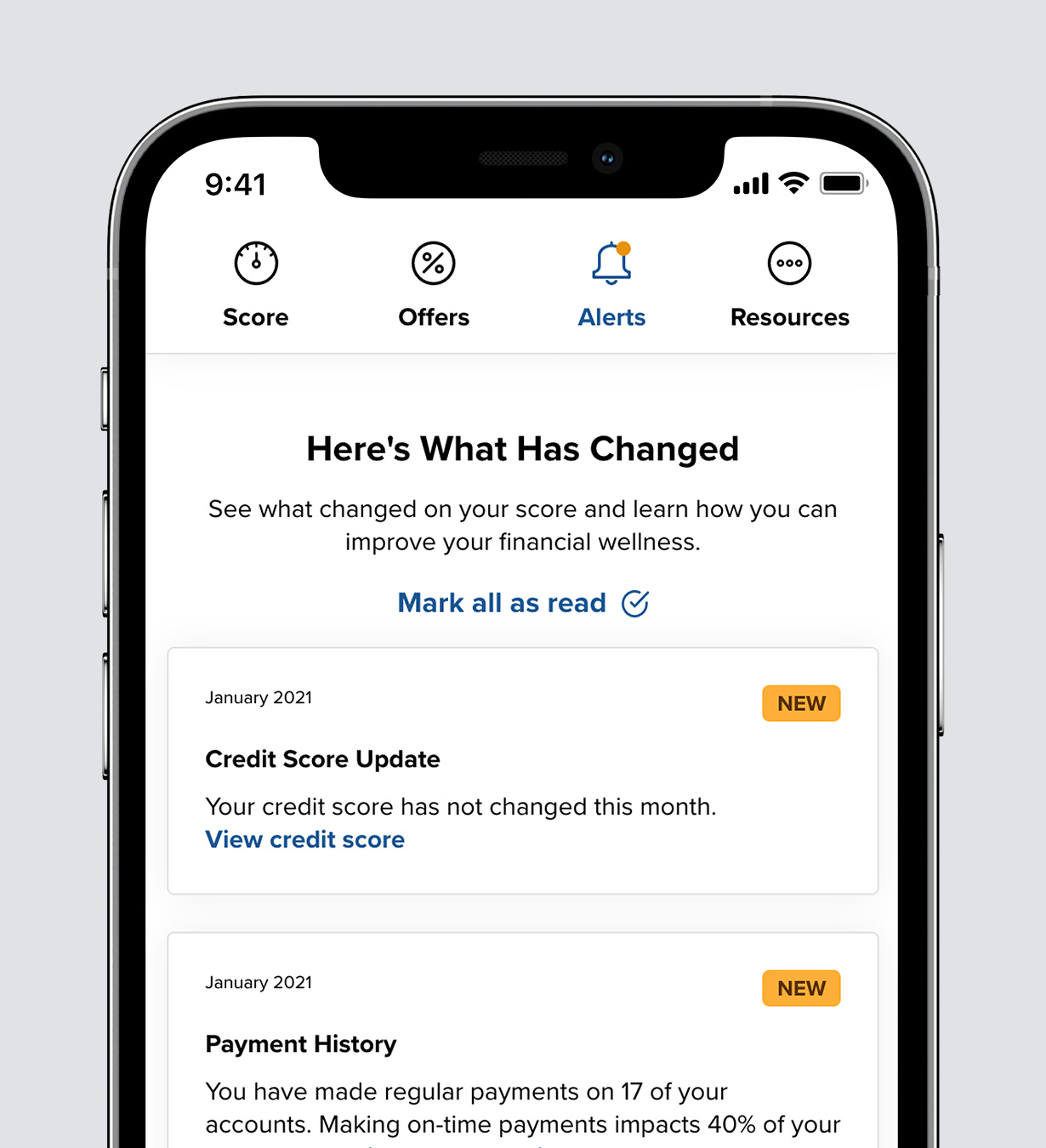

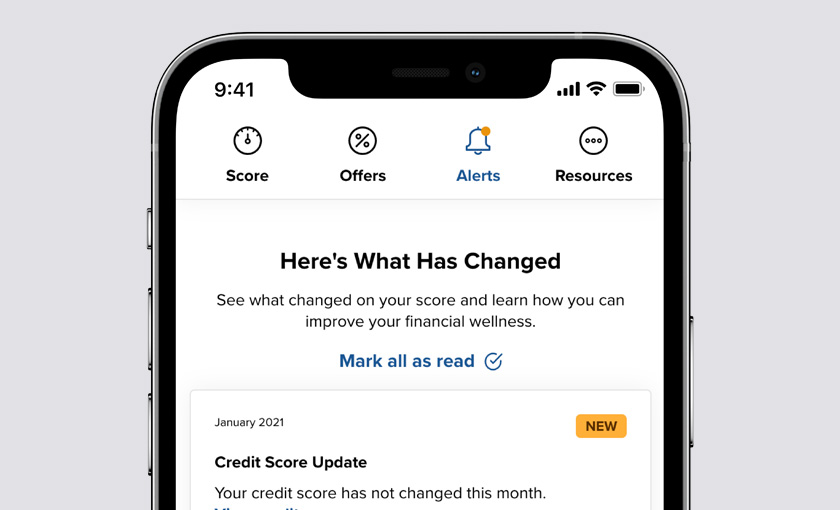

- Monitor credit for unusual activity

- Get alerts for changes to your credit

- View your full credit report

- Visualize what affects your credit score

- Simulate how future actions may impact your score

- Dispute items on your credit report

- Get tips on rebuilding credit & saving money

- Get instant offers based on your credit