10 Healthy Financial Resolutions for 2023

According to a recent survey, one in three Americans are planning to shape up their finances in 2023, with 31% of people making it their resolution. To help you make the most of this opportunity for financial reflection and self-improvement, here’s a smart list of New Year’s resolutions to help you become financially fit this year:

1.) Save for a Rainy Day: People who lack an emergency fund are tempting fate, putting themselves at financial risk. Building a fund with about 12 to 18 months’ take-home income is a smart strategy. Note, it may not happen overnight and you don’t need to put your financial life on hold until your emergency fund is complete. Rather, chip away at it over time.

2.) Take Advantage of Employer Investment Plans: Including 401(k), 403(b) or IRAs. Especially if your employer matches a percentage of your investment. Generally, you won’t have to pay taxes on these contributions and earnings until you begin withdrawing on them after retirement.

3.) Fight Back Against Inflation: After months of heightened inflation, goods cost more and portions are smaller. There are steps you can take to reduce the impact of inflation on your bottom line. Research everything you buy by taking advantage of deals and coupons, buy in bulk and cut back until prices come down.

4.) Make a Realistic Budget & Stick to It: Gather your bills from the past few months and make a list of all your recurring expenses. Then rank them in order of importance, with true necessities such as housing, food and healthcare obviously taking the top spots. After that, you can simply cut from the bottom of your list until your take-home exceeds what you plan to spend.

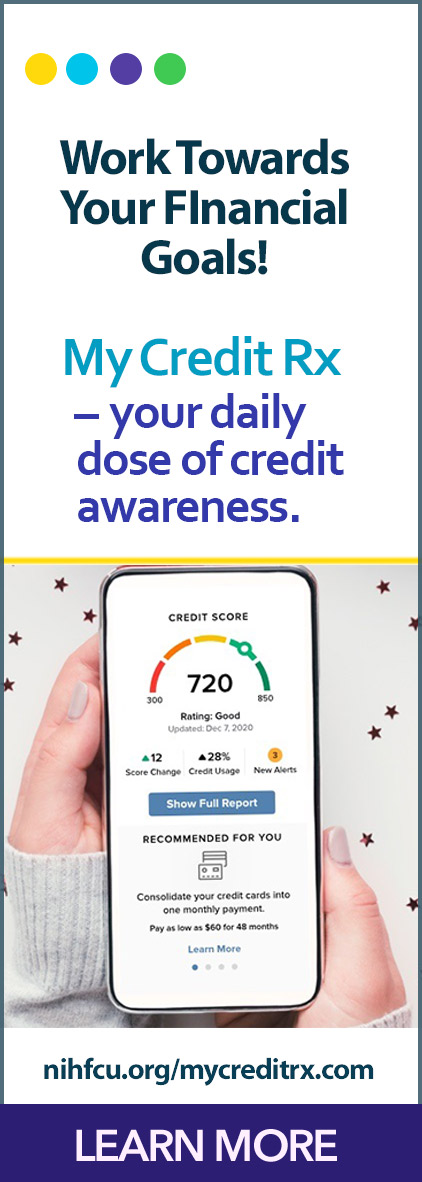

5). Sign Up for Credit Monitoring with MyCredit Rx: Too few of us are familiar with the actual contents of our credit reports. That might be because we assume our credit scores tell the full story, but that’s just not the case. As many as one in four people have an error on their report that could affect their credit score. Reviewing your credit score on a regular basis with NIHFCU’s free MyCredit Rx will allow you to check your credit score, view your credit report, get up-to-date credit monitoring updates and spot signs of fraud.

6.) Pay Bills Right After Receiving Your Paycheck: Take care of monthly obligations before letting yourself indulge in any luxury expenses. Set up two automatic monthly payments from a deposit account: one for right after payday and another for a couple days before your monthly due date. The second payment will help you avoid interest on any purchases made between your first payment and the end of your billing period.

7.) Use Different Credit Cards for Everyday Purchases & Debt: The Island Approach involves using different accounts to serve different financial needs, as if they are a chain of islands. The most basic example is using a rewards credit card for everyday purchases and a 0% APR card for balances that you’ll carry from month to month. Doing so enables you to get the best possible terms on each card, rather than settling for average terms on a single card.

8.) Prepare a Will: Just as life insurance is important for you and your family, a will outlines exactly how your personal estate of funds, property and personal affects will be distributed. About half of all Americans die without a will, leaving the final distribution of your personal state to the courts, and not to you. Having a will is especially important with young families because it allows you to choose a guardian for your children.

9.) Pay Attention to Physical Health: There is a clear connection between physical, emotional and financial health, and it was particularly apparent in 2022. The average person spends about $12,530 on health care each year. This underscores the importance of getting your financial house in order as well as engaging in other healthy practices aimed at reducing health care costs.

10.) Meet with a Financial Counselor: They can help you understand your current financial reality, and where you would ideally want to be, based on your current age and financial goals. Not sure what your goals are? At NIHFCU, a GreenPath Financial Wellness counselor can share some “tried and true” advice on how to start building your New Years Financial Resolutions. They can help you gain a better understanding of your financial picture and what steps to take to improve financial wellness.