New Law Allows Free Access to Your Credit Report Every Week

Looking for something good that came from the pandemic? Well, Americans are saving more than ever before and seem to be far more serious about their financial future. If you’re looking to make some moves in 2021, a good place to start is understanding your credit. Typically the federal government allows Americans to access their credit reports once a year for free, but during the pandemic, the three credit bureaus—Equifax, Experian, and TransUnion have all opened that up to once a week through April 20, 2022. This is a great chance for you to get a good sense of where you stand with your credit at no cost to you. Let’s take a look at why understanding your credit report is so important.

Errors on Your Credit Report

Monitoring your report can help you identify fraudulent activity or errors on your report that could damage your credit score. A free credit report could help you identify and report any issues, and a second pull of a free report a month or so later could help you ensure that they are removed.

Pandemic Specific Issues

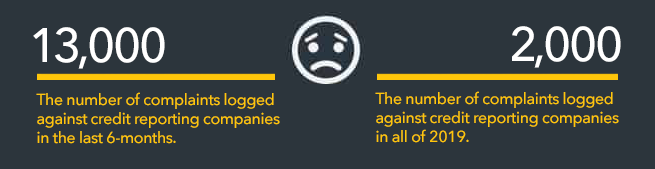

Many companies offered specific pandemic-related programs to help alleviate financial strain on borrowers. If you took advantage of any of these programs, such as modified payment arrangements, deferred payments, or forbearance, you should be aware of how they are reflected on your credit report. In addition, credit reporting companies are responding to disputes slower during the pandemic, creating even more of a need for checking back in on your credit report.

Access Your Free Weekly Credit Report

Getting your free credit report from all three credit reporting companies is easy and can be done through one website that was setup by Equifax, Experian, and TransUnion. Just visit annualcreditreport.com and follow the prompts. If you’re a member of NIH Federal Credit Union you can work directly with our partner Greenpath to get a free review of your credit report. They will assist you in recognizing errors and ensuring that your data is represented correctly.