Get a mortgage you'll love this summer.

Save up to $2,500 on closing costs, plus quick closing and rate locks up to 60 days.*

Also, earn 20% of your agent’s commission* with HomeAdvantage®

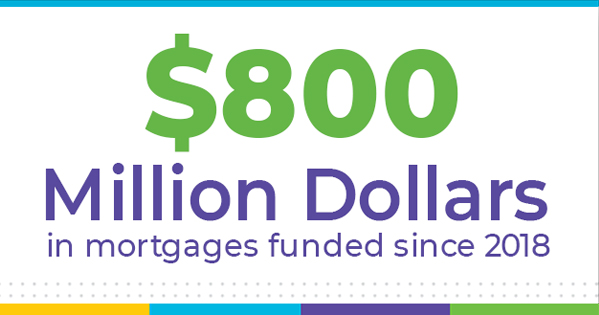

The NIH Federal Credit Union helping homeowners achieve their dreams is part of our DNA.

Save up to $2,500 on closing costs, plus quick closing and rate locks up to 60 days.*

Also, earn 20% of your agent’s commission* with HomeAdvantage®

Helping homeowners find their next dream home is in our DNA! Let us guide you.

Loans or lines to finance virtually any household or personal need.

Unsecured loans for those without cash or equity to upgrade their home

“Your fast pre-approval and appraisal process, changed the dynamics of our home purchase and put a lot of power in our hands. And you did that very quickly, in a way that is very shocking to all including myself, my agent, the builder and their financial partners… my gratitude to you is endless!”

Akitunde, Member since 2012

Success begins with the team, and our team of residential loan officers is second to none.

Contact our team today

1-855-203-4747

Rates, fees and terms as of June 30, 2025 and subject to change without notice